Intrinsic value calculator excel

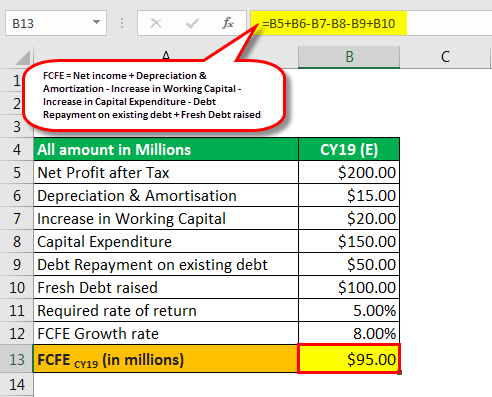

Let us take the example of a company named JKL Inc. Download Corporate Valuation Investment Banking Accounting CFA Calculator others The formula for gross margin is very simple and can be derived by dividing the difference between the net sales and the cost of goods sold by the net sales which is then expressed in terms of percentage by multiplying with 100.

Intrinsic Value Formula Example How To Calculate Intrinsic Value

If it is given in the value the calculating person has to convert that to price with the help of the beginning price and then should use it for calculation.

. It is a public listed company and as per available information its unlevered beta of 09 while its total debt and market capitalization stood at 120 million and 380 million respectively as on December 31 2018. The market cap represents the value of the entire company to only one group of capital providers which is the common shareholders. Or Y 514 040 X.

Beta using the correlation formula is calculated as. Well now move to a modeling exercise which you can access by filling out the form below. Next determine the ending inventory which is the value of the inventory at the end of the period.

However the mean which is most commonly used remains the best measure of central tendency despite the existence of mean median and mode. But today we are focusing on a different method for calculating a stocks intrinsic value. Mode refers to the most frequently occurred value in the data set.

Price to Earning Ratio Formula in Excel With Excel Template Here we will do the same example of the PE Ratio formula in Excel. Money Multiplier Formula Table of Contents Formula. Here we discuss to calculate Statistics with examples.

We also provide a calculator with an excel template. Company B 600mm. To calculate the enterprise value of a company you first take the companys equity value and then add net debt preferred stock and minority interest.

Investors should ideally buy the stocks at near the intrinsic value of the company. The simplest calculation of enterprise value is equity value plus net debt. What is the Money Multiplier Formula.

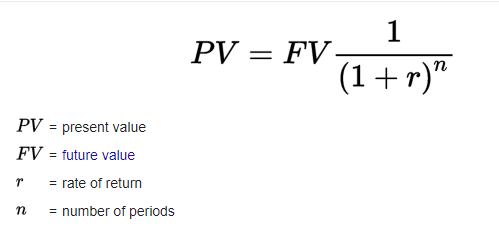

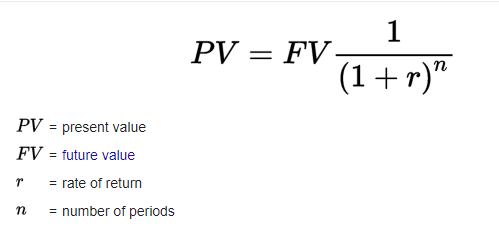

The concept of present value is primarily based on the time value of money which states that a dollar today is worth more than a dollar in the future. To illustrate the computation of levered beta. Market Price of Share and Earnings per Share.

You can easily calculate the Current Ratio using Formula in the template provided. Firstly determine the dependent variable or the variable that is the subject of prediction. The formula for fixed cost can be calculated by using the following steps.

The formula for the attrition rate can be computed by using the following steps. Note down the value of BV which is nothing but the present value or the beginning price. Our starting point the equity value ie.

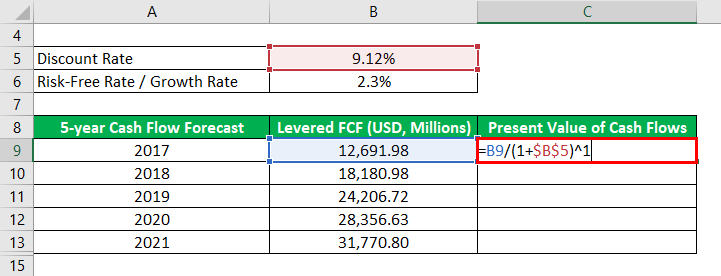

Current Ratio Formula in Excel With Excel Template Here we will do the same example of the Current Ratio formula in Excel. We have to calculate the net present value with manual formula and excel function and discount factor for a period of 7 months the discount rate for same is. We discuss how to use a DCF model in more detail here and you can download our free stock valuation excel template here.

Discount Factor Formula Example 3. Company A 0mm. Finally the formula for cost of sales can be derived by adding beginning inventory step 1 raw material purchase step 2 cost of direct labor step 3 and overhead manufacturing cost step 4 minus ending inventory step 5 as.

It is very easy and simple. Net Working Capital Total Current Assets Total Current Liabilities. In addition you can find whether the.

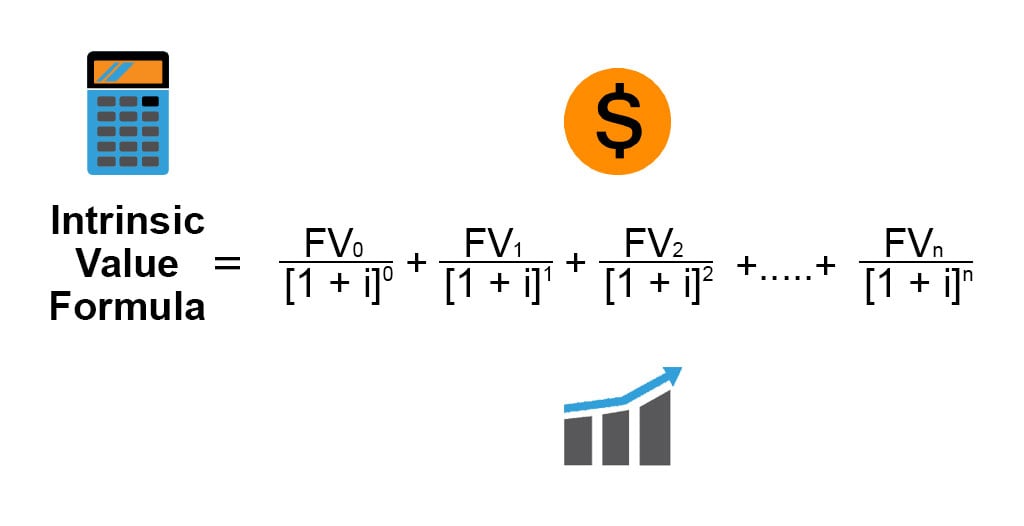

Intrinsic Value DCF Guide Intrinsic Value DCF Guide Intrinsic Value Concepts Intrinsic Value Time Value of Money TVM Present Value PV Future Value. The data mode can be found with normal data set group data set and a non-grouped or ungrouped data set. Fixed Cost Explanation.

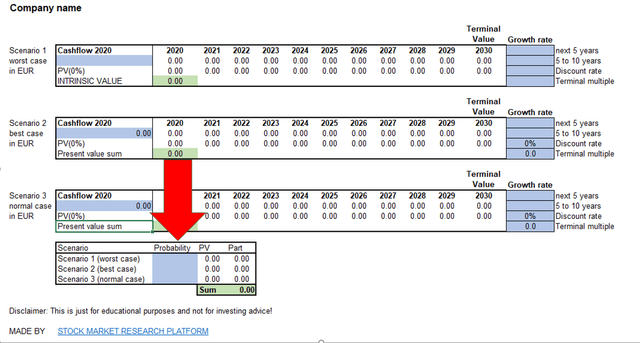

Company C 12bn. Intrinsic value is often calculated using a discounted cash flow DCF model. It is very easy and simple.

Next determine the explanatory or independent variable for the regression line. The risk-free rate refers to the implied yield on a risk-free investment with the standard proxy being the 10-year US. Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc.

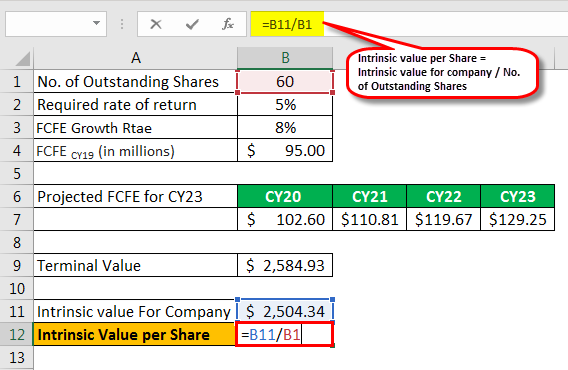

This intrinsic value is the real value of the company based on its cash flows assets and financial situation. It is denoted by Y i. Guide to Statistics Formula.

Levered and Unlevered Beta Calculator Excel Template. Further if the number of compounding per year n is known then the formula for present value can be expressed as PV CF 1 rn tn. You need to provide the two inputs ie Current assets and Current liability.

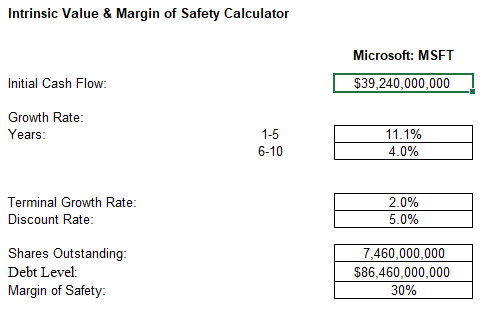

However with a 5 discount rate the valuation would completely change and go to above 5. Once we add the 4bn in market cap to the corresponding net debt value of each company we get different enterprise values for each. The term money multiplier refers to the phenomenon of credit creation due to the fractional reserve banking system under which a bank is required to hold a certain amount of the deposits in its reserves in order to be able to meet any potential.

Regression Line Formula Y a b X. Beta Formula in Excel With Excel Template Here we will do the same example of the Beta formula in Excel. Attrition Rate 20 310.

Attrition Rate 65 Therefore the firms attrition rate for the year 2018 was 65. It is very easy and simple. You can easily calculate the PE Ratio using Formula in the template provided.

Net working capital 7793 Cr Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. However the result value of CAGR is considered in giving only. Intrinsic Value Calcluation Formula and Example.

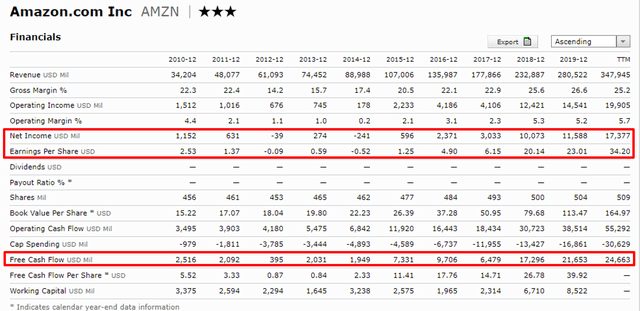

If Amazon keeps growing at 25 we use a valuation of 30 and a discount rate of 10 the current intrinsic value is 3397 per share which would still have AMZN trade below its intrinsic value. You need to provide the two inputs ie. As the name suggests these costs are variable in nature and changes with the increase or.

Levered Beta Formula Example 1. Regarding the net debt figures use the following assumptions. SP 500 and the return of risk-free securities.

How to Calculate the Equity Risk Premium ERP The equity risk premium or the market risk premium is equal to the difference between the rate of return received from riskier equity investments eg. Let us see another example to understand functions. The Best Intrinsic Value Calculator.

You can easily calculate the Beta using Formula in the template provided. DCF Calculator is used for calculating the intrinsic value IV in other words the true value of the company. We should assume that.

Y a b X. For bonds which pays coupons will have maturity value which equals to its par value because all the interest is paid in the form of coupons. Relevance and Uses of Maturity Value Formula Since maturity value is the amount which an investor will get at the maturity of the contract this is a very useful concept which helps investors to see what.

The best intrinsic value calculator is Stock Rover which automatically calculates Fair Value Academic Fair Value Intrinsic Value Intrinsic Value to Sales and the intrinsic Value Exit Multiple for all US stocks. Net working capital 106072 98279. Download the Intrinsic Value Margin Safety Excel Calculator xls.

The Regression Line Formula can be calculated by using the following steps.

Calculating The Intrinsic Value Of Stocks Hardwarezone Forums

How To Calculate The Intrinsic Value Of A Stock Excel Calculator

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

Stock Market Secret How To Always Buy Low And Sell High Watch How I Consistently Buy Low And Sell High In The Stock Market By Calculating The Intrinsic Value Of A

Intrinsic Value Formula Example How To Calculate Intrinsic Value Intrinsic Value Intrinsic Company Values

How To Find The Intrinsic Value Of A Stock In Excel Graham Intrinsic Value Formula Youtube

Value Shares With Graham S Formula

Intrinsic Value Formula Examples Of Intrinsic Value With Excel Template

Intrinsic Value Formula Example How To Calculate Intrinsic Value

5 Steps To Calculate Intrinsic Value Youtube

Intrinsic Value Calculator Excel Intrinsic Value Calculator Template

How To Find The Intrinsic Value Of A Company S Stock In Excel Eps Multiplier Method Youtube

How To Calculate Intrinsic Value Formula Excel Template Amzn Example Sven Carlin

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich